| Title | Responsible Commodities Facility – Cerrado Programme 1 |

| Country/Location | Brazil |

| Size of Investment | USD 47 million |

| Revenue Model | Green agribusiness receivables certificates enable farmers to produce sustainable soy crops through low interest loans. |

| Private Investment/Finance Structure | Four-year green bonds (green agribusiness receivables certificates – ‘CRAs’) with private sector investment from corporates and banks |

| Public/Philanthropic Investment | USD 150,000 seed funding for the development of the Responsible Commodities Facility |

| Env/Social Impact | Production of sustainable soy, carbon storage, conservation of native vegetation in Brazil’s Cerrado Biome |

Summary

The Responsible Commodities Facility provides financial incentives to farmers, in the form of low interest loans, to produce soy in existing cleared and degraded lands in order to discourage further expansion into the Brazilian Cerrado. A USD 11 million pilot fund was launched in 2022 with four-year green bonds bought by Tesco, Sainsburys and Waitrose. The facility was increased in 2023 to USD 47 million with the addition of Santander, Rabobank and AGRI3 as investors [1].

Background

Growing demand for soy is leading to the deforestation of large tracts of vegetation in the Cerrado Biome in Brazil, the vast tropical savannah that covers about 20% of the country. Some 85% of this happens legally under Brazil’s Forest Code. Deforestation in the Cerrado has increased greenhouse gas emissions and decreased biodiversity, and is one the biggest environmental challenges facing Brazil.

Pedro Moura Costa, Co-founder and CEO of Sustainable Investment Management (SIM) and Co-founder and Director of BVRio Environmental Exchange

However, Brazil’s soy farming sector can expand without clearing any more natural vegetation in the Cerrado. The amount of cleared land currently available for soy cultivation in the area is already three times what the industry needs, according to Pedro Moura Costa, co-founder and CEO of Sustainable Investment Management (SIM) and co-founder and director of BVRio Environmental Exchange, a Brazilian NGO that creates market mechanisms to solve environmental problems.

Call to Action

Deforestation in the Cerrado became so severe that, in 2017, over 60 Brazilian civil society organisations, including BVRio, signed the Cerrado Manifesto, calling for immediate action from the Brazilian government, soy buyers, traders and investors to protect the Brazilian Cerrado [2].

The same year, CEOs from 23 global companies, including Tesco, Sainsburys, Waitrose, Ikea, Unilever, Nestle, McDonald’s and Walmart, signed a Statement of Support for the Cerrado Manifesto, committing to support the objectives of the Cerrado Manifesto and to halt deforestation in the Cerrado. In 2024, 57 companies had signed the Statement of Support.

BVRio signed both the manifesto and the Statement of Support, but both still had to be put into action. “We needed a mechanism to provide incentives to soy farmers so that they opt to use already cleared land, instead of expanding into the Cerrado,” says Moura Costa.

Inception

As a result, Moura Costa created The Responsible Commodities Facility (RCF), an initiative to promote the production and trading of responsible soy in Brazil by creating a vehicle to provide financial incentives to farmers to choose already cleared land. The development of the RCF received USD 150,000 in seed funding from Good Energies Foundation and a group of Forest Positive Coalition companies.

“We were working on the RCF in 2018 and 2019 and we were ready to launch our first USD 300 million debt fund at the end of 2019. We even had an announcement at the London Stock Exchange,” says Moura Costa. However, the arrival of the Covid-19 pandemic soon afterwards meant that the launch was no longer viable, and the idea of the Fund was put on hold.

At the beginning of 2021, however, a small subgroup of those companies that had signed the Statement of Support came together to look at various financial instruments, including the RCF, which could help to deliver the objectives of the group. The decision was made to relaunch the RCF’s debt fund with a small pilot project to demonstrate the concept, managed by SIM, which could be scaled in the years to come.

The result was the Cerrado Programme, which was announced in August 2022. Under the programme, Tesco, Sainsburys and Waitrose, which were all active members of the subgroup, bought USD 11 million of four-year green bonds (green agribusiness receivables certificates), issued and registered on the Vienna Stock Exchange, to capitalise a debt fund.

All three participating supermarkets receive a coupon, while the pilot fund, in turn, advances low interest rate loans to large soy farmers in the Cerrado that meet its eligibility criteria.

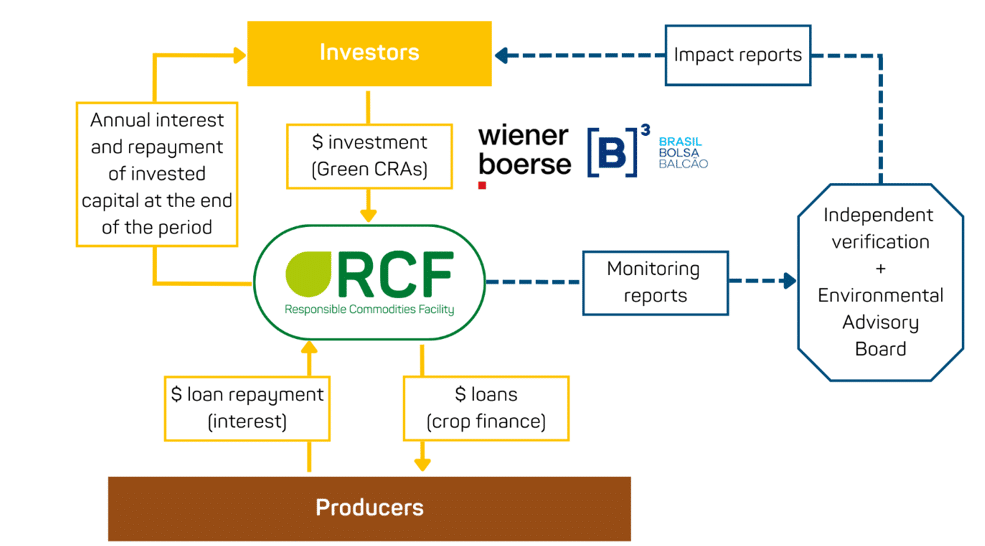

Investment structure of the RCF:

Source: Bvrio

Eligibility of Farmers

Under the Fund’s structure, all the farmers have been pre-selected so 100% of the capital raised by the bonds has already been disbursed. For the pilot, this was 36 farms of nine large farming groups. Each farming group received on average about USD 1 million from the Fund. In year two the number of participating farms rose to 122 with 23 farming groups.

To be eligible for the Programme, farmers must commit to zero deforestation of any native vegetation in their farms. Additionally, they must be in full compliance with Brazil’s Forest Code, have the right to use the land, and demonstrate that they do not contravene any environmental or legal requirements.

The cultivation area to be financed must also have been cleared before 1st January 2020 and must have more native vegetation than the Legal Reserves and Areas of Permanent Protection (APPs) required by law.

The RCF’s goal is to recruit eligible farms that are not so large that they can raise funds in international markets themselves, but not so small that they can survive on the official agricultural credit lines provided by the Brazilian government. An immediate source of expansion will be other farms within the same farming groups that are already receiving funding from the RCF.

To recruit enough eligible farmers for a much larger fund, the RCF is working with an organization called Traive Finance, an agricultural credit analyst. “[Traive] reaches out to farmers and say there is a new product out there and explain how it works,” says Moura Costa. “[Traive] carries out a full credit analysis of those farms that are interested, and we then do a full environmental analysis. We submit these to the credit committee and if accepted, they sign contracts and join the portfolio.” Then, green bonds (green agribusiness receivables certificates, CRAs) are issued by securitisation company Opea Capital.

Measuring Impact

The programme will reduce the conversion of Cerrado habitats, conserve carbon stocks and biodiversity, and support the production of sustainable soy. It is expected to generate the following impacts over a four-year period:

- The production of 1 million tonnes of deforestation-free and conversion-free soy

- The conservation of 150,000 hectares of native vegetation, including 30,000 hectares of Excess Legal Reserves that could otherwise be legally deforested

- 20 million tonnes of carbon stored in forests maintained by the programme

Each participating farm will be continuously monitored and independently verified at the end of each crop cycle by EarthDaily Agro, using satellite imagery and CAR verification.

The environmental impacts of the programme together with the impact of each individual farm will be independently verified and reported to the Environmental Committee. Participants in the Committee include The Nature Conservancy, Conservation International, WWF, IPAM Amazonia, the UN Environment Programme and Proforest. BVRio acts as the secretariat of the committee.

What’s Next – Scaling and Replicating

The plan is to ramp the Fund up to USD 100 million in 2025, with a subordinated tranche for corporate participants and Development Financial Institutions, and a senior tranche for institutional investors from the debt capital markets. The subordinated tranche will lower the cost of capital for the senior tranche, enabling the facility to offer low interest loans to farmers at scale. The plan is for the existing single-tranche pilot Fund of corporate investors to be subsumed into the larger Fund, once it is launched.

Moura Costa says that creating interest among large institutional investors for the senior tranche is easier, while finding more corporate participants for the subordinated tranche is harder. “After all, these are not dedicated impact investors, but consumer goods companies looking for a tool to remove deforestation from their supply chains,” he says. “We also need a lot more farmers to understand, subscribe and sign on to the programme. We’ve been working on that, but it’s not without its challenges.

Longer term, the RCF plans to structure a series of programmes to tackle environmental challenges and promote sustainable agriculture for a range of different crops. Moura Costa points to the opportunity to provide loans for farmers that produce low methane rice, for example, given that irrigated rice is one of the biggest emitters of methane worldwide.

In each case, the new programmes will be financed through green bonds. This is not just because there is huge appetite from impact investors for green bonds that have a credit rating and provide the right risk-adjusted returns, but also because Moura Costa believes that debt is a better way of financing sustainable agriculture than equity.

“Everyone is talking about nature-based solutions, where equity funds become owners of investments, but in sustainable agriculture, investment funds can’t go around buying large tracts of land,” he says. He points out that in Brazil, private ownership of land is allowed, but not with foreign capital, while in parts of Southeast Asia and Africa, there’s very little private ownership of land at all.

“The land belongs to the inhabitants of the country, the local communities and indigenous people,” he says. “By providing debt finance, funds don’t own the assets, but can inflict transformational impacts, because they can provide incentives to large numbers of existing landowners.”

Updated as of October 2024

Sources:

- Sustainable Investment Management (2024) Responsible Commodities Facility

- Fairr (2024) Cerrado Manifesto

- Interview with Pedro Moura Costa, Director of BVRIo