| Title | Forest Resilience Bond |

| Country/Location | California, United States |

| Size | > USD 30 million |

| Revenue Model | Cooperative agreements, grant agreements, performance-based/ cost-share contracts with highly rated federal, state, municipal, and corporate counterparts |

| Private Investment/Finance Structure | Concessional and market rate loans |

| Public/Philanthropic Investment | Federal and State Grants |

| Env/Social Impact | Forest restoration, reduced wildfire risk, resilient biodiversity habitat, carbon stability, increased water supply protection, local job creation |

Summary

Blue Forest, a non-profit, has developed a conservation finance model to finance forest restoration across the United States, known as the Forest Resilience Bond (FRB). The model utilises a blended finance structure and leverages public and private capital to provide upfront capital for restoration activities while utilities, governments, and other public and private entities that benefit from a healthy forest re-pay the investment. Blue Forest launched its first FRB in 2018, which successfully closed and repaid investors in 2023, and has scaled and replicated the model which now supports 4 active FRBs.

Background

Unnaturally dense and homogenous forests, resulting from fire suppression, removal of Indigenous People and cultural burning practices, and climate change, can lead to greater susceptibility to disease outbreak, degraded watersheds, and stunted biodiversity. The California wildfires of 2020/21 were one example of how these risks can materialise on a massive scale. Activities such as mechanical thinning, along with prescribed burning and meadow restoration, can mitigate some of the above risks and restore forests.

Zach Knight, co-founder and CEO of Blue Forest, highlights the challenge of financing forest conservation. “Government is increasingly recognising the need for funding.” The Bipartisan Infrastructure Law and Inflation Reduction Act has a total of USD 5 billion available, but the Forest Service’s Wildfire Crisis Strategy (which has the goal to reduce the risk of wildfire across 50 million acres of state, private, and federal lands over the next 10 years) will cost an estimated USD 50-100 billion across 10 years. “Stakeholders are increasingly aware that this is not a science problem, it is a finance problem”

Blue Forest was originally founded by a team of students at UC Berkeley’s Haas School of Business, who developed the concept of the Forest Resilience Bond in 2015 as part of the Kellogg-Morgan Stanley Sustainable Investing Challenge.

The team recognised multiple beneficiaries would be willing to pay for forest restoration and catastrophic wildfire prevention, such as utility companies, local government and forestry organisations. This presented an opportunity for a repayment model that could attract private lenders or investors. Investors themselves could achieve a financial return while enabling projects with broad ecological and social benefits.

Engaging Beneficiaries

In 2015, Blue Forest started to develop the FRB in partnership with the World Resources Institute (WRI), the USDA Forest Service and the National Forest Foundation (NFF). Blue Forest selected the Yuba River Watershed in the Tahoe National Forest as its first project location – around 15,000 acres.

It identified three beneficiaries to pay for restoration activities:

- The USDA Forest Service

- The California Department of Forestry and Fire Protection

- Yuba Water Agency (YWA)

Blue Forest first approached the USDA Forest Service, which manages 193 million acres of forest and grassland, in addition to the California Department of Forestry and Fire Protection. While both beneficiaries recognised the benefits of the FRB, there were concerns about the involvement of private finance. For example, the Service’s annual budget cycle was not conducive to committing to a multi-year reimbursement agreement, nor could it legally benefit from private investment.

Zach Knight, co-founder and CEO of Blue Forest

Blue Forest also engaged with the Yuba Water Agency (YWA), a water utility provider that directly benefited from the ecosystem services that the healthy forests in the Yuba River Watershed provided. These ecosystem services were primarily derived from fuels reduction activities such as thinning and prescribed burning, meadow restoration, and aspen regeneration. Economic analysis conducted by Blue Forest’s partner (World Resources Institute) and YWA showed that the project would deliver large net benefits to YWA through the protection of their hydropower generation and reduced wildfire risk.

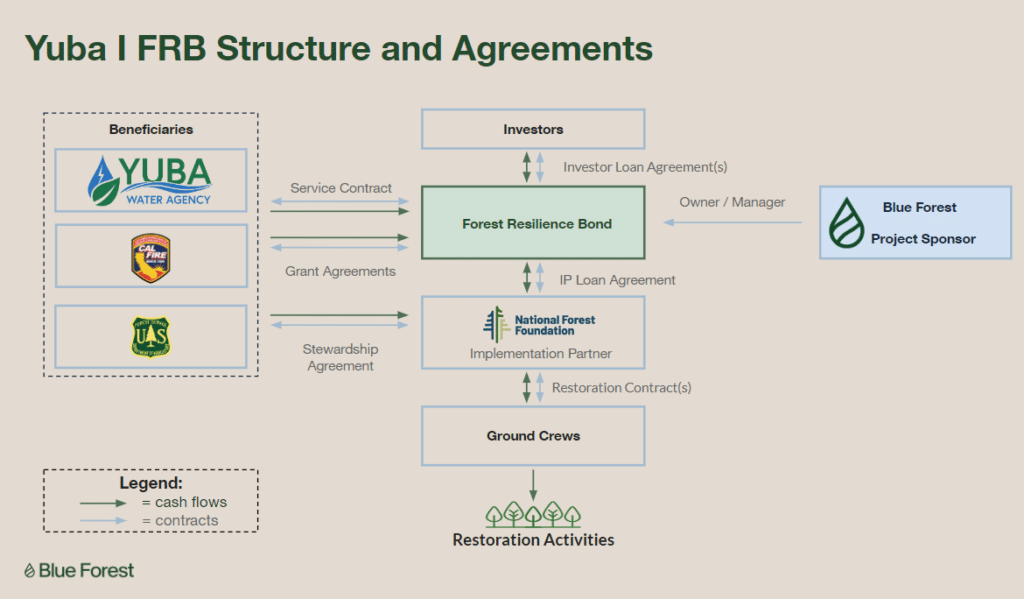

After engaging with the identified beneficiaries, Blue Forest developed a structure that drew on project financing and was familiar in the private investment market by establishing Special Purpose Vehicles (SPVs) for each restoration project. The SPV was created as a wholly owned subsidiary by Blue Forest that would receive funds from the investors, passing these onto the implementation partner, which itself had formal agreements with the Forest Service and the California Department of Forestry and Fire Protection (see implementation diagram below). This meant that the Forest Service and California Department of Forestry and Fire Protection had no legal connection to the SPV, allowing them to act as beneficiaries.

Payment Agreements

Determining the share and method of payments for the project was challenging. Blue Forest considered a pay-for-performance model, which ties the amount and frequency of repayment to environmental outcomes, such as soil quality or water run-off.

However, the pay-for-performance structure was removed due to the complexities of tying environmental outcomes to payment agreements. Beneficiaries and investors preferred not to include the pay-for success model and instead opted for fixed repayments based on the economic value of the environmental outcomes that would be delivered, which reduces risk for investors and ultimately lowered the cost of capital for investors.

Investor repayment of the FRB is instead tied to ‘repayment milestones’, such as federal and state funding that is reimbursable upon project completion. In this sense, the Forest Resilience Bond is not a financial bond, but a fixed repayment lending structure.

In 2018, Blue Forest established the Yuba I FRB with the payment agreements totalling USD 4 million over a maximum of five years. This included payments from:

- Yuba Water Agency: a fee for services contract, with fixed payments over five years

- Forest Service: in-kind and cash contributions and the value of merchantable timber that arises from the restoration work

As well as grants from public entities:

- California Department of Forestry and Fire Protection: USD 2.6 million grant, reimbursable after work is completed

- Sierra Nevada Conservancy grant: up to USD 0.25 million

Implementation Structure

A separate implementation partner was necessary for the structure as it’s not possible to lend private funds to a federal agency. For the Yuba I FRB, the Forest Service selected the National Forest Foundation – a congressionally chartered non-profit partner of the Forest Service – as the implementation partner.

The structure is set up so that the National Forest Foundation receives 0% interest loans and grants from the SPV to hire local contractors on the ground. It receives grant reimbursement from the federal and state agencies once the completed work is verified, repaying these to the SPV when required.

This structure also solves a key financial barrier that many smaller local contractors face in forest restoration; local contractors can often wait up to six months for federal and state funding to be reimbursed for completed work, leading to a working capital shortage. The private investment that the FRB leveraged helps to bridge this gap, and therefore support local contractors.

Finally, the Forest Service also has a stewardship agreement directly with the National Forest Foundation. This allows the value of products (e.g., sellable timber) to be used to pay for service work. It enabled the Forest Service to enter into projects for longer timeframes of up to 20 years.

Within the structure, the Forest Service is project planner and overseer, the National Forest Foundation acts as the implementation partner, and Blue Forest acts as the financial sponsor and managing partner.

See below a graphic of the investment and implementation structure:

Source: Blue Forest

Identifying Investors

As part of the blended finance approach, Blue Forest leveraged concessionary and commercial investors to provide the upfront capital to finance the project.

The FRB secured USD 4 million investment from the Rockefeller Foundation and the Gordon & Betty Moore Foundation, which had been initial project development funders.

For the commercial investors, Blue Forest approached CSAA Insurance. From a risk mitigation perspective, CSAA insured thousands of customers living in the area who were at risk of wildfire, and therefore the work would reduce the risk of insured losses. CSAA was also looking to diversify its investment portfolio with ESG-aligned activity and predicted that the FRB would be a repeatable proposition as it gained market traction.

Calvert Impact Capital was the second commercial investor – an impact investor that was looking to support market building transactions, which also provided support on some of the key documentation of the transaction.

In total the investment consisted of:

- USD 2m of commercial capital with a 4% per annum return

- USD 2m of concessional capital with a 1% per annum return

All lenders ranked pari passu – meaning that all investors were ranked equally in terms of the repayment order.

To ensure deal integrity, Blue Forest ensured that there was no undue influence from investors. The Forest Service determined the priority restoration locations and treatments before Blue Forest engaged with investors and finalised the project plans before taking commitments from the capital.

For the Yuba I FRB, Blue Forest spent over 18 months determining the contracting process to meet requirements of private investors, foundations, and government agencies – some of whom had never worked with private investors previously. Knight remarks that their second project launched more quickly with the replicable structures they had developed.

A key learning as part of this process relates to the marketing period, which Knight remarks was too short. “For the second FRB, our marketing period was open for about a month before we were oversubscribed, which means we might have missed investors that could have been great partners.” This learning led to the FRB Catalyst Facility, a fund structure that aggregates projects and allows for larger investment sizes.

Success to Date

The FRB formally launched in October 2018, and restoration work started in 2019.

The project timeline was delayed due to the 2021 fire season, but in 2023 Blue Forest announced the successful completion of the pilot.

Investors received their expected returns. The FRB has resulted in [1]:

- 2,675 acres of ecosystems restored

- 8,024 acres of ecosystems protected

- 27,601 acre-feet of source water supply protected

- 72 jobs sustained

The successful launch of the Yuba I FRB also led to the formation of the North Yuba Forest Partnership, which is a partnership of nine federal, Tribal, state and local government agencies [2]. The North Yuba Forest Partnership recognizes that the North Yuba River Watershed resides within the Ancestral and Traditional homelands of the Nisenan Tribe and intertribal regions of the Mountain Maidu, Konkow, and Washoe. The Partnership focuses on restoring 275,000 acres of public and private lands in the North Yuba River Watershed, including the Yuba II FRB. The NYFP was key in developing restoration plans for a 275k acre footprint in two years.

Scaling and Replicating the Model

The success of the first Yuba FRB led to a second SPV which was launched in the same area, the Yuba II FRB. The same partners and contract structures were used to scale up restoration work from 15,000 to 50,000 acres with USD 25 million of financing over a five year period. The marketing period closed in October 2021 and restoration work started soon after. Through the Yuba I FRB, Blue Forest realised that the ideal target footprint for project investment and implementation is on the order of 50,000 acres. Large enough to be impactful and require significant investment, but manageable enough to plan and complete all the restoration work required. This solidified Blue Forest’s future in FRBs, by developing pilots in regions to engage beneficiaries, realise impact, and utilise that to scale into a full, larger, project area through a second FRB.

The launch of the North Yuba Forest Partnership also reenforced Blue Forest’s impact in developing collaborations. Community buy-in is essential when working at the larger landscape, which can only be done through broad partnerships including community organisations, and is a pillar of Blue Forest’s approach of science + finance + collaboration.

Blue Forest has continued to scale up and replicate the model. In 2023, the FRB Catalyst Facility was created which is a pooled investment vehicle, with revolving loans [3]. The Facility is aiming for 10 investments of FRBs across Western US. The Facility aims to leverage its initial capital into more than USD 50 million worth of project activities [4]. The Facility has received support from the Rockefeller Foundation and Alumbra Innovations Foundation. Additional investors include private foundation and impact asset managers. In 2023, the Facility made its first investment in Southwestern Oregon into the Rogue Valley I FRB, and in 2024, launched the Upper Wenatchee I FRB in Washington, and the Upper Mokelumne I FRB in California.

Additional use cases for the Forest Resilience Bond are in exploration at Blue Forest, including the pilot of a Watershed Resilience Bond in Southern Oregon-Northeastern California (SONEC I WRB), reducing barriers to implementation and funding for conservation projects on private working lands.

Updated as of October 2024

Sources:

- Blue Forest (2023) Yuba I FRB

- Blue Forest (2023) The North Yuba Forest Partnership: On being named Partnership of the Year

- PR Newswire (2023) Protecting Watersheds and Preventing Catastrophic Wildfire: Yuba I Forest Resilience Bond Returns Investor Capital, Driving Successful Restoration Efforts on the Tahoe National Forest

- PR Newswire (2023) Blue Forest Launches the FRB Catalyst Facility and its First Forest Resilience Bond (FRB) in Oregon

- Interview with Zach Knight, Co-founder and CEO of Blue Forest Conservation

- Listen here to Zach Knight share about the project in Episode 11 of Financing Nature.